Regional Economics Applications Laboratory (REAL)

The Regional Economics Applications Laboratory (REAL) is no longer in operation

Discussion Papers

These are in the process of being stored and available on the Regional Research Institute’s website at West Virginia University. Further access details will be provided over the coming months.

PyIO and REAL IO

The input-output toolbox is being relocated to the REGIOlab at the University of Oviedo in Spain, where it will be maintained and enhanced. Further access details will be provided over the coming months.

Models and Other Information

The Regional Econometric Input-Output Models, Metropolitan Indices and Business Cycle Indicators, Regional Computable General Equilibrium Models are no longer being maintained. For information and documentation on these models and requests for other information about REAL, please contact Dr. Geoffrey Hewings at 217-333-4740 or hewings@illinois.edu.

Visiting Scholars

REAL is no longer hosting visiting scholars. Prospective visiting scholars are encouraged to explore options at the Regional Research Institute, West Virginia University (https://rri.wvu.edu); the Regional Economic Development Institute at Colorado State University (https://redi.colostate.edu); City-REDI, University of Birmingham, UK (https://www.birmingham.ac.uk/research/city-redi/index.aspx); or REGIOlab at the University of Oviedo, Spain (https://regiolab.es). For further assistance, contact Geoffrey Hewings at 217-333-4740 or hewings@illinois.edu.

International Network

Monitoring the IL Economy

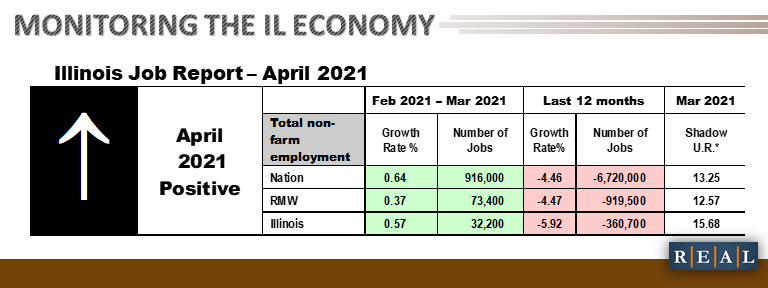

Illinois Economic Review Report – Apr

– The 12-month forecast shows that Illinois is likely to experience an employment increase of 326,900 jobs by March 2022. The greatest increase is likely to occur in Trade, transportation & utilities (110,500 more jobs).

– The state of Illinois now has a net loss of 251,900 jobs since the beginning of the recession in December 2007.

See the full report (Released: 05/31/2021)

Illinois Job Report – Apr

– Illinois gained 32,200 jobs in March 2021. The top three job-gain sectors were Leisure & hospitality (13,700 more jobs), Construction (6,300 more jobs), and Other Services (2,000 more jobs). The top three sectors that lost jobs in March in Illinois were Government (2,600 less jobs), Information (200 less jobs), and Financial activities (700 less jobs).

– In March, Illinois’s official unemployment rate was 7.1% while its shadow unemployment rate was 15.7%. To bring the two rates together, in other words bringing down shadow unemployment rate to 7.1%, another 586,700 jobs need to be created.

– The Nation gained 916,000 jobs at a rate of 0.64% in March, compared with a revised 468,000-job gain in February 2021. The top three job-gain sectors were Leisure & hospitality (280,000 more jobs), Construction (110,000 more jobs), and Other Services (42,000 more jobs).

– The RMW gained 73,400 jobs in March after a 40,500-job gain in February 2021.

– The 12-month-ahead job recovery forecasts show that the future recovery rates in Illinois will increase for every sector.

See the full report (Released: 05/31/2021)

MSA Job Report – Apr

– Illinois Rural area gained 2,800 jobs at 0.38% this month, compared to a revised 7,300-job gain in February 2021. At the same time, Metro gained 29,400 jobs at 0.59% in March compared to a revised 30,000-job gain in the previous month. Consequently, the 32,200-job gain in Illinois was mainly driven by positive performances in all areas.

See the full report (Released: 05/31/2021)

The Chicago Business Activity Index (CBAI) – June

– The Chicago Business Activity Index (CBAI) slightly decreased to 103.4 in April from 103.9 in March. The decrease is mainly attributed to decline in expected retail sales. However, the CBAI still surpasses 100, which indicates that the economy is on a recovery path.

See the full report (Released: 06/15/2021)

MSA Business Index and Forecast – Apr

– According to the forecast for February 2022, Peoria is likely to perform worse over this period than Chicago, all other MSAs will fare better than Chicago.

See the full report (Released: 05/31/2021)